Overview

To start integrating with theTeller API, you need a theTeller merchant account. See how to setup here: Setting up on theTeller.

TheTeller API helps you create any type of payments flow from payment acceptance, e-commerce, recurring billing and a whole lots more.

Setting up an Account on Theteller

Setting up a merchant account is as easy as possible, simply sign up Signup Here . When you complete the signup form a verification mail will be sent to you to verify your email. Upon successful verification, our support team will contact you via email or phone call.

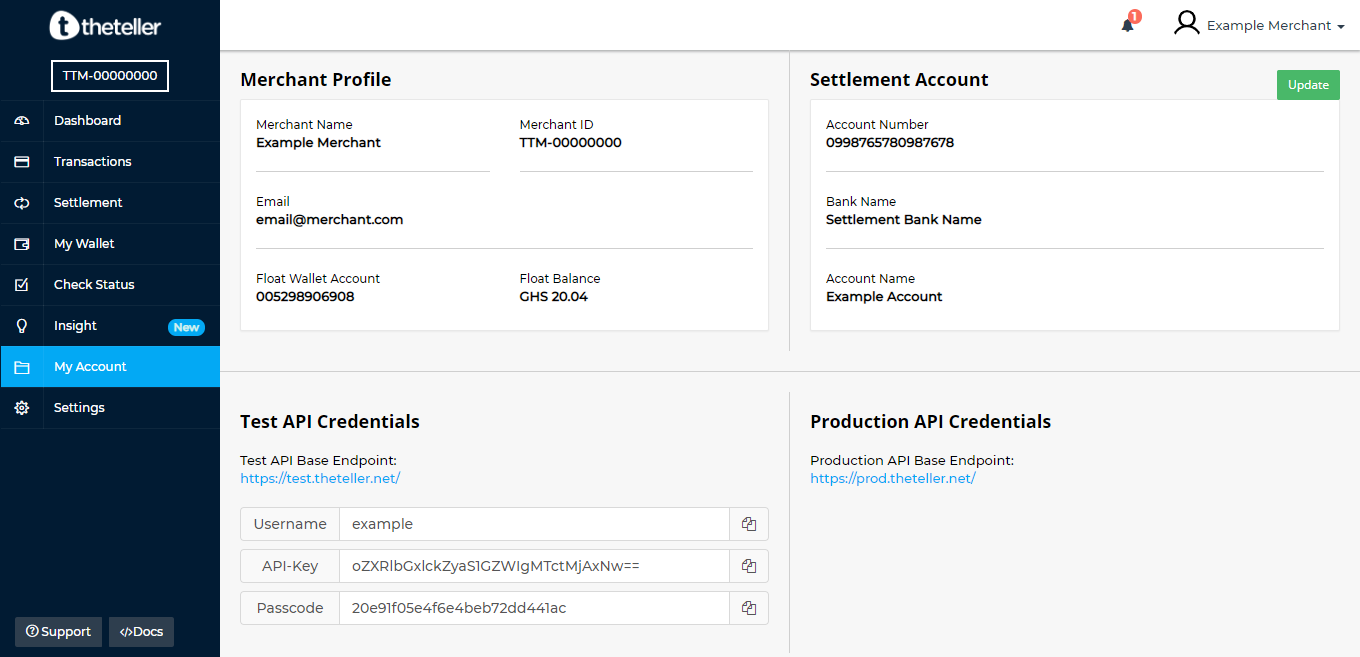

Test Credentials

Test API credentials will be created for your account to facilitate the integration phase. you can find your API credentials on your merchant dashbaord when you sign in.

Signin to AccountLive Credentials

To go live simply contact our support team. Contact Support

Adding Theteller to your website

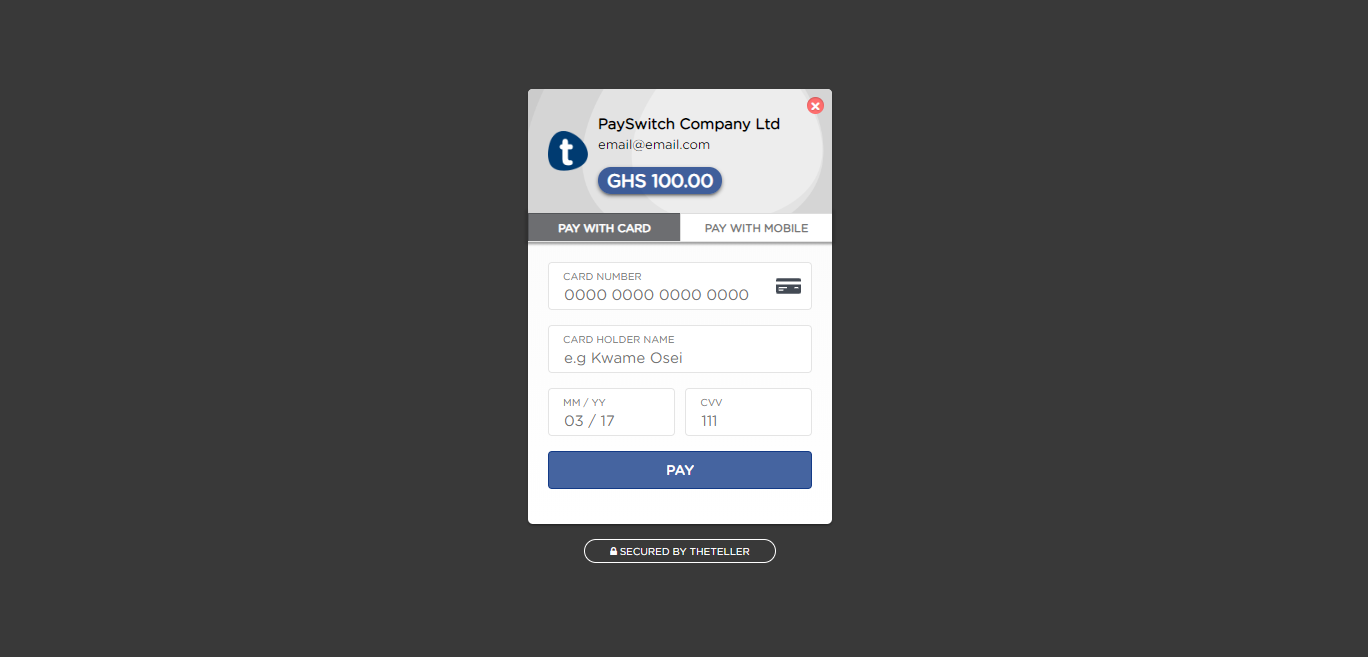

How Our New Theteller Inline JS Modal looks

The Theteller inline JS code method is the easiest way to start accepting payment on your web applications. It offers a secure and convenient flow for users. The best part is that payment is done on your page, thereby eliminating the need to redirect to another page.

Before going forward we might have eCommerce and mobile app plugins that can help you get started immediately on a platform of your choice. Click on the Plugins option below to see plugins for Theteller.

See PluginsTheteller Standard Checkout

This shows you how to accept payments fast with Theteller Standard Checkout Page

Accept payment quickly and securely using the standard method by calling the

/initiate endpoint.

When you call the endpoint we return a response with a payment link, do a

redirect

to the link and a secure payment form would be loaded for your customer to

enter

their payment details. When the transaction is completed we would call your

redirect_url and

append the payment response as query parameters.

Step 1: Collect payment details.

Collect the following data and send as a json payload to the /initiate.

| Parameter | Required | Data Type | Description |

|---|---|---|---|

| merchant_id | true | string | Your merchant ID provided when you create an account. |

| transaction_id | true | string | Unique transaction reference provided by you and must be 12 digits. |

| desc | true | string | Text to be displayed as a short transaction narration. |

| amount | true | string | Amount to charge. |

| redirect_url | true | string | URL to redirect to when transaction is completed. |

| true | string | Email of the customer. | |

| API_Key | true | string | Your merchant API key provided when you create an account. |

| apiuser | true | string | Your merchant API Username provided when you create an account. |

Step 2: Initialise the payment.

After collecting payment details initialise the payment by calling our API with the payment details, see an example below.

LIVE EndPoint

Method: POST

Endpoint/BaseURL: https://checkout.theteller.net/initiate

//Request Headers

Content-Type: application/json

Authorization: Basic base64_encode('your API username:your API Key')

Cache-Control: no-cache

//Request Body

{

"merchant_id":"Your merchant ID",

"transaction_id":"000000000000",

"desc":"Payment Using Checkout Page",

"amount":"000000000100",

"redirect_url":"http://redirect_url/response",

"email":"customer_email"

}

$payload = json_encode(["merchant_id"=>"Your merchant ID", "transaction_id"=>"000000000000",

"desc"=>"Payment Using Checkout Page", "amount"=>"000000000100",

"redirect_url"=>"https://yoursite.com", "email"=>"mail@customer.com"]);

$curl = curl_init();

curl_setopt_array($curl, array(

CURLOPT_URL => "https://test.theteller.net/checkout/initiate",

CURLOPT_RETURNTRANSFER => true,

CURLOPT_ENCODING => "",

CURLOPT_MAXREDIRS => 10,

CURLOPT_TIMEOUT => 30,

CURLOPT_HTTP_VERSION => CURL_HTTP_VERSION_1_1,

CURLOPT_CUSTOMREQUEST => "POST",

CURLOPT_POSTFIELDS => $payload,

CURLOPT_HTTPHEADER => array(

"Authorization: Basic ".base64_encode('Your API Username:Your API Key')."",

"Cache-Control: no-cache",

"Content-Type: application/json"

),

));

$response = curl_exec($curl);

$err = curl_error($curl);

curl_close($curl);

if ($err) {

echo "cURL Error #:" . $err;

} else {

echo $response;

}

string authorization = your api user + ":" + your api key;

var conversion = Encoding.UTF8.GetBytes(authorization);

var encoded_authorization = Convert.ToBase64String(conversion);

var client = new RestClient("https://test.theteller.net/checkout/initiate");

var request = new RestRequest(Method.POST);

request.AddHeader("Cache-Control", "no-cache");

request.AddHeader("Authorization", "Basic "+encoded_authorization);

request.AddHeader("Content-Type", "application/json");

request.AddParameter("{\r\n \"merchant_id\": \"Your Merchant ID\",\r\n \"transaction_id\":\"000000000000\",

\r\n \"desc\": \"Payment Using Checkout Page\",\r\n \"amount\": \"000000000100\",\r\n \

"redirect_url\": \"https://yoursite.com\",\r\n\"email\":\"email@customer.com\"\r\n}",

ParameterType.RequestBody);

IRestResponse response = client.Execute(request);

byte[] code = "Your_API_User:Your_API_KEY ".getBytes(StandardCharsets.UTF_8);

String encoded = Base64.getEncoder().encodeToString(code);

OkHttpClient client = new OkHttpClient();

MediaType mediaType = MediaType.parse("application/json");

RequestBody body = RequestBody.create(mediaType,

"{\r\n \"merchant_id\": \"Your Merchant ID\",\r\n \"transaction_id\":\"000000000000\",\r\n \"desc\": \"Payment Using Checkout

Page\",\r\n \"amount\": \"000000000100\",\r\n \"redirect_url\": \"https://yoursite.com\",\r\n\"email\":\"email@customer.com\"\r\n}");

Request request = new Request.Builder()

.url("https://test.theteller.net/checkout/initiate")

.post(body)

.addHeader("Content-Type", "application/json")

.addHeader("Authorization", "Basic " + encoded)

.addHeader("Cache-Control", "no-cache")

.build();

Response response = client.newCall(request).execute();

Sample Response

{

"status": "success",

"code": 200,

"reason": "Token successfully generated",

"token": "eU1xSFN5Ky92MUt5dmpnT",

"checkout_url": "https://test.theteller.net/checkout/checkout/eU1xSFN5Ky92MUt5dmpnT"

}

If the request is successful, a token and a full checkout url is

returned

as response. you are to redirect the user to the checkout page

using

the url value in the checkout_url field.

What happens when the user completes the transaction on the page?

When the user enter's their payment details, Theteller would validate then charge the card or mobile money. Once the charge is completed we would:

-

Call your

redirect urland post the response to you via url encoded data, we also append your transaction ID as query params to the url. -

Send an email to you and your customer on the successful payment. If email to customers is turned off we wouldn't send emails.

Sample Callback Response

https://redirect_url?code=000&status=successful&reason=transaction20%successful&transaction_id=000000000000

Checking payment response / verifying transaction.

When a transaction is completed we append the transaction

ID,

status, code, reason to your

redirect

URL. you can check the status of the transaction using the transaction

ID.

In

the example below we show a code snipet to check transaction status

Method: GET

Endpoint: /v1.1/users/transactions/Replace with transaction ID/status

//Request Headers

Content-Type: application/json

Merchant-Id: Your Merchant ID

Cache-Control: no-cache

$curl = curl_init();

$transaction_id = "000000000000";

curl_setopt_array($curl, array(

CURLOPT_URL => "https://test.theteller.net/v1.1/users/transactions/".$transaction_id."/status",

CURLOPT_RETURNTRANSFER => true,

CURLOPT_ENCODING => "",

CURLOPT_MAXREDIRS => 10,

CURLOPT_TIMEOUT => 30,

CURLOPT_HTTP_VERSION => CURL_HTTP_VERSION_1_1,

CURLOPT_CUSTOMREQUEST => "GET",

CURLOPT_HTTPHEADER => array(

"Cache-Control: no-cache",

"Merchant-Id: Your Merchant ID"

),

));

$response = curl_exec($curl);

$err = curl_error($curl);

curl_close($curl);

if ($err) {

echo "cURL Error #:" . $err;

} else {

echo $response;

}

string transaction_id = "000000000000";

var client = new RestClient("https://test.theteller.net/v1.1/users/transactions/"+transaction_id+"/status");

var request = new RestRequest(Method.GET);

request.AddHeader("Cache-Control", "no-cache");

request.AddHeader("Merchant-Id", "Your Merchant ID");

IRestResponse response = client.Execute(request);

string transaction_id = "000000000000";

OkHttpClient client = new OkHttpClient();

Request request = new Request.Builder()

.url("https://test.theteller.net/v1.1/users/transactions/"+transaction_id+"/status")

.get()

.addHeader("Merchant-Id", "Your Merchant ID")

.addHeader("Cache-Control", "no-cache")

.build();

Response response = client.newCall(request).execute();

Sample Response

{

"code": "000",

"status": "approved",

"reason": "Transaction Successful",

"transaction_id": "000000000267",

"r_switch": "VIS",

"subscriber_number": "************1999",

"amount": 1

}

Fund Transfers

This section describes how to transfer funds from merchant float account to mobile money or bank account.

One of the core functionalities of Theteller API is to make transferring funds as easy as it gets, regardless of the payment channels or mode of collection, the process of moving funds is meant to be effortless and secure.

To complete a successful fund trasfer, ensure you have setup a merchant transfer float account on the Theteller Dashboard. Login now to setup float account. When a transfer request is initiated, the merchant transfer float account is debited. In cases of failed fund transfers, a reversal is done.

Request Parameters

| Parameter | Required | Type | Description |

|---|---|---|---|

| merchant_id | true | string | Your merchant API key provided when you create an account. |

| transaction_id | true | string | Unique transaction reference provided by you. |

| amount | true | string | Amount to charge. |

| processing_code | true | string | This is a transaction type identifier. 404000 is default for

transfer

to mobile money. 404020 for bank transfer |

| r-switch | true | string | Account issuer or network on which the account to be debited resides. default is "FLT" for float |

| desc | true | string | Text to be displayed as a short transaction narration. |

| pass_code | true | string | Unique pass code generated when you create a float account. |

| account_number | true | string | Recipient account number or wallet number for transfer transaction. |

| account_issuer | true | string | The network the account belongs to. e.g "MTN" for MTN "ATL" for Airtel "ZPY" for Zeepay "GMY" for G-money "VDF" for Vodafone "TGO" for Tigo "GIP" for bank account transfer |

| account_bank | true | string | The recipient bank account, e.g "GCB" for Ghana commercial bank. See All Banks |

To Mobile Money

Theteller API makes it possible to transfer funds to any mobile money service provider in Ghana. This allows merchants transfer funds from their merchant transfer float account to any valid mobile money number subscribed on MTN, Airtel, Tigo, Vodafone network instantly.

Method: POST

Endpoint: /v1.1/transaction/process

//Request Headers

Content-Type: application/json

Authorization: Basic base64_encode('your API username:your API Key')

Cache-Control: no-cache

//Request Body

{

"account_number":"0240000000",

"account_issuer":"MTN",

"merchant_id":"Your Merchant ID",

"transaction_id"=>"000000000000",

"processing_code"=>"404000",

"amount"=>"000000000020",

"r-switch"=>"FLT",

"desc"=>"Float Transfer Test",

"pass_code"=>"Your Pass code"

}

$data = json_encode(["account_number"=>"0240000000", "account_issuer"=>"MTN", "merchant_id"=>"Your Merchant ID",

"transaction_id"=>"000000000000", "processing_code"=>"404000", "amount"=>"000000000020",

"r-switch"=>"FLT", "desc"=>"Float Transfer Test", "pass_code"=>"Your Pass code"]);

$curl = curl_init();

curl_setopt_array($curl, array(

CURLOPT_URL => "https://test.theteller.net/v1.1/transaction/process",

CURLOPT_RETURNTRANSFER => true,

CURLOPT_ENCODING => "",

CURLOPT_MAXREDIRS => 10,

CURLOPT_TIMEOUT => 30,

CURLOPT_HTTP_VERSION => CURL_HTTP_VERSION_1_1,

CURLOPT_CUSTOMREQUEST => "POST",

CURLOPT_POSTFIELDS => $data,

CURLOPT_HTTPHEADER => array(

"Authorization: Basic base64_encode('Your API Username:Your API Key')",

"Cache-Control: no-cache",

"Content-Type: application/json",

),

));

$response = curl_exec($curl);

$err = curl_error($curl);

curl_close($curl);

if ($err) {

echo "cURL Error #:" . $err;

} else {

echo $response;

}

string authorization = your api user + ":" + your api key;

var conversion = Encoding.UTF8.GetBytes(authorization);

var encoded_authorization = Convert.ToBase64String(conversion);

var client = new RestClient("https://test.theteller.net/v1.1/transaction/process");

var request = new RestRequest(Method.POST);

request.AddHeader("Cache-Control", "no-cache");

request.AddHeader("Authorization", "Basic "+encoded_authorization);

request.AddHeader("Content-Type", "application/json");

request.AddParameter("{ \r\n \"account_number\": \"0240000000\",\r\n

\"account_issuer\": \"MTN\",\r\n \"merchant_id\": \"Your merchant ID\",\r\n \"transaction_id\": \"000000000000\",\r\n \"processing_code\":

\"404000\",\r\n \"amount\": \"000000000020\",\r\n \"r-switch\": \"FLT\",\r\n \"desc\": \"Float Transfer Test\",\r\n \"pass_code\":

\"Your pass code\" \r\n}\r\n", ParameterType.RequestBody);

IRestResponse response = client.Execute(request);

byte[] code = "Your_API_User:Your_API_KEY ".getBytes(StandardCharsets.UTF_8);

String encoded = Base64.getEncoder().encodeToString(code);

OkHttpClient client = new OkHttpClient();

MediaType mediaType = MediaType.parse("application/json");

RequestBody body = RequestBody.create(mediaType,

"{ \r\n \"account_number\": \"0240000000\",\r\n \"account_issuer\": \"MTN\",\r\n \"merchant_id\": \"Your merchant ID\",\r\n \"transaction_id\":

\"000000000000\",\r\n \"processing_code\": \"404000\",\r\n \"amount\": \"000000000020\",\r\n \"r-switch\": \"FLT\",\r\n \"desc\":

\"Float Transfer Test\",\r\n \"pass_code\": \"Your pass code\" \r\n}\r\n");

Request request = new Request.Builder()

.url("https://test.theteller.net/v1.1/transaction/process")

.post(body)

.addHeader("Content-Type", "application/json")

.addHeader("Authorization",

"Basic "+encoded)

.addHeader("Cache-Control", "no-cache")

.build();

Response response = client.newCall(request).execute();

To Bank Account

Now you can credit any local bank account in Ghana instantly with Theteller API. Theteller API provides the functionality for merchants to transfer funds from their float account to any bank account in Ghana.

Method: POST

Endpoint: /v1.1/transaction/process

//Request Headers

Content-Type: application/json

Authorization: Basic base64_encode('your API username:your API Key')

Cache-Control: no-cache

//Request Body

{

"account_number":"0082000141685300",

"account_bank":"GCB",

"account_issuer":"GIP",

"merchant_id":"Your Merchant ID",

"transaction_id":"000000000000",

"processing_code":"404020",

"amount":"000000000020",

"r-switch":"FLT",

"desc":"Float Transfer Test",

"pass_code":"Your Pass code"

}

$data = json_encode(["account_number"=>"0082000141685300", "account_bank":"GCB", "account_issuer"=>"GIP", "merchant_id"=>"Your Merchant ID",

"transaction_id"=>"000000000000", "processing_code"=>"404020", "amount"=>"000000000020",

"r-switch"=>"FLT", "desc"=>"Float Transfer Test", "pass_code"=>"Your Pass code"]);

$curl = curl_init();

curl_setopt_array($curl, array(

CURLOPT_URL => "https://test.theteller.net/v1.1/transaction/process",

CURLOPT_RETURNTRANSFER => true,

CURLOPT_ENCODING => "",

CURLOPT_MAXREDIRS => 10,

CURLOPT_TIMEOUT => 30,

CURLOPT_HTTP_VERSION => CURL_HTTP_VERSION_1_1,

CURLOPT_CUSTOMREQUEST => "POST",

CURLOPT_POSTFIELDS => $data,

CURLOPT_HTTPHEADER => array(

"Authorization: Basic ".base64_encode('Your API Username:Your API Key')."",

"Cache-Control: no-cache",

"Content-Type: application/json",

),

));

$response = curl_exec($curl);

$err = curl_error($curl);

curl_close($curl);

if ($err) {

echo "cURL Error #:" . $err;

} else {

echo $response;

}

string authorization = your api user + ":" + your api key;

var conversion = Encoding.UTF8.GetBytes(authorization);

var encoded_authorization = Convert.ToBase64String(conversion);

var client = new RestClient("https://test.theteller.net/v1.1/transaction/process");

var request = new RestRequest(Method.POST);

request.AddHeader("Cache-Control", "no-cache");

request.AddHeader("Authorization", "Basic "+encoded_authorization);

request.AddHeader("Content-Type", "application/json");

request.AddParameter("{ \r\n \"account_number\": \"0082000141685300\",\r\n \"account_bank\":\"UMB\",\r\n

\"account_issuer\": \"MTN\",\r\n \"merchant_id\": \"Your merchant ID\",\r\n \"transaction_id\": \"000000000000\",\r\n \"processing_code\":

\"404020\",\r\n \"amount\": \"000000000020\",\r\n \"r-switch\": \"FLT\",\r\n \"desc\": \"Float Transfer Test\",\r\n \"pass_code\":

\"Your pass code\" \r\n}\r\n", ParameterType.RequestBody);

IRestResponse response = client.Execute(request);

byte[] code = "Your_API_User:Your_API_KEY ".getBytes(StandardCharsets.UTF_8);

String encoded = Base64.getEncoder().encodeToString(code);

OkHttpClient client = new OkHttpClient();

MediaType mediaType = MediaType.parse("application/json");

RequestBody body = RequestBody.create(mediaType,

"{ \r\n \"account_number\": \"0082000141685300\",\r\n \"account_bank\":\"UMB\",\r\n \"account_issuer\": \"MTN\",\r\n \"merchant_id\": \"Your merchant ID\",\r\n \"transaction_id\":

\"000000000000\",\r\n \"processing_code\": \"404020\",\r\n \"amount\": \"000000000020\",\r\n \"r-switch\": \"FLT\",\r\n \"desc\":

\"Float Transfer Test\",\r\n \"pass_code\": \"Your pass code\" \r\n}\r\n");

Request request = new Request.Builder()

.url("https://test.theteller.net/v1.1/transaction/process")

.post(body)

.addHeader("Content-Type", "application/json")

.addHeader("Authorization",

"Basic "+encoded)

.addHeader("Cache-Control", "no-cache")

.build();

Response response = client.newCall(request).execute();

Sample Response

{

"status": "successful",

"code": "000",

"reference_id": "153600134089",

"account_name": "Kweku Adjei",

"reason": "Success"

}

On successful name enquiry response, the account name associated to the provided account number is returned. To continue the transfer, confirm that the account name is actually the account you wish to credit.

To complete bank transfer, make the below request.

Complete Bank Transfer

Method: POST

Endpoint: /v1.1/transaction/bank/ftc/authorize

//Request Headers

Content-Type: application/json

Authorization: Basic base64_encode('your API username:your API Key')

Cache-Control: no-cache

//Request Body

{

"merchant_id":"Your Merchant ID",

"reference_id":"000000000000"

}

$data = json_encode(["merchant_id"=>"Your Merchant ID", "reference_id"=>"000000000000"]);

$curl = curl_init();

curl_setopt_array($curl, array(

CURLOPT_URL => "https://test.theteller.net/v1.1/transaction/bank/ftc/authorize",

CURLOPT_RETURNTRANSFER => true,

CURLOPT_ENCODING => "",

CURLOPT_MAXREDIRS => 10,

CURLOPT_TIMEOUT => 30,

CURLOPT_HTTP_VERSION => CURL_HTTP_VERSION_1_1,

CURLOPT_CUSTOMREQUEST => "POST",

CURLOPT_POSTFIELDS => $data,

CURLOPT_HTTPHEADER => array(

"Authorization: Basic ".base64_encode('Your API Username:Your API Key')."",

"Cache-Control: no-cache",

"Content-Type: application/json",

),

));

$response = curl_exec($curl);

$err = curl_error($curl);

curl_close($curl);

if ($err) {

echo "cURL Error #:" . $err;

} else {

echo $response;

}

string authorization = your api user + ":" + your api key;

var conversion = Encoding.UTF8.GetBytes(authorization);

var encoded_authorization = Convert.ToBase64String(conversion);

var client = new RestClient("https://test.theteller.net/v1.1/transaction/bank/ftc/authorize");

var request = new RestRequest(Method.POST);

request.AddHeader("Cache-Control", "no-cache");

request.AddHeader("Authorization", "Basic "+encoded_authorization);

request.AddHeader("Content-Type", "application/json");

request.AddParameter("{\n \"merchant_id\": \"TTM-00000001\",\n \"reference_id\": \"153600134089\"\n}", ParameterType.RequestBody);

IRestResponse response = client.Execute(request);

byte[] code = "Your_API_User:Your_API_KEY ".getBytes(StandardCharsets.UTF_8);

String encoded = Base64.getEncoder().encodeToString(code);

OkHttpClient client = new OkHttpClient();

MediaType mediaType = MediaType.parse("application/json");

RequestBody body = RequestBody.create(mediaType,

"{\n \"merchant_id\": \"TTM-00000001\",\n \"reference_id\": \"153600134089\"\n}");

Request request = new Request.Builder()

.url("https://test.theteller.net/v1.1/transaction/bank/ftc/authorize")

.post(body)

.addHeader("Content-Type", "application/json")

.addHeader("Authorization",

"Basic "+encoded)

.addHeader("Cache-Control", "no-cache")

.build();

Response response = client.newCall(request).execute();

Payments

This section describes how to collect payments directly from your web application.

Merchant who are PCI DSS Compliant and have a secured system in place can send card details directly from their application to Theteller to process.

Request Parameters

| Parameter | Required | Type | Description |

|---|---|---|---|

| merchant_id | true | string | Your merchant API key provided when you create an account. |

| transaction_id | true | string | Unique transaction reference provided by you. |

| amount | true | string | Amount to charge. |

| processing_code | true | string | This is a transaction type identifier. 404000 is default for

transfer

to mobile money "000000" for card payment "000200" for mobile money payment |

| r-switch | true | string | Account issuer or network on which the account to be debited

resides. "VIS" for Visa "MAS" for MasterCard "MTN" for MTN "VDF" for Vodafone "ATL" for Airtel "TGO" for Tigo |

| desc | true | string | Text to be displayed as a short transaction narration. |

| customer_email | true | string | Your customer email. |

| card_holder | true | string | Card holder name on card. |

| currency | true | string | Currency to charge card |

| pan | true | string | card pan number on card |

| exp_month | true | string | Expiry month of card |

| exp_year | true | string | Expiry year of card |

| cvv | true | string | CVV on back of card |

| 3d_url_response | true | string | Callback url to return your user to when transaction is completed |

| subscriber_number | true | string | Mobile money wallet to charge |

Card Payments

Theteller API processes VISA, MasterCard and TelaCards, other card schemes will be added to the list soon. Every request requires the following request headers.

//Request Headers

Content-Type: application/json

Authorization: Basic base64_encode('your API username:your API Key')

Cache-Control: no-cache

To complete a successful payment request send the following request

Method: POST

Endpoint: /v1.1/transaction/process

//Request Headers

Content-Type: application/json

Authorization: Basic base64_encode('your API username:your API Key')

Cache-Control: no-cache

//Request Body

{

"processing_code":"000000",

"r-switch":"VIS",

"transaction_id":"000000000000",

"merchant_id":"Your merchant ID",

"pan":"4310000000000000",

"3d_url_response":"your_redirect_url",

"exp_month":"05",

"exp_year":"21",

"cvv":"000",

"desc":"Card Payment Test",

"amount":"000000000100",

"currency":"GHS",

"card_holder":"Card Holder Name",

"customer_email":"Customer Email"

}

Sample Response

{

"transaction_id":"000000000000",

"status": "approved",

"code": "000",

"reason": "Transaction successful!"

}

Card Reversal

Theteller API allows you to process reversal transaction from VISA, MasterCard and TelaCards. Every request requires the following request headers.

//Request Headers

Content-Type: application/json

Authorization: Basic base64_encode('your API username:your API Key')

Cache-Control: no-cache

To process a reversal request send the following request

Method: POST

Endpoint: https://prod.theteller.net/rest/resources/card/reversal

//Request Headers

Content-Type: application/json

Authorization: Basic base64_encode('your API username:your API Key')

Cache-Control: no-cache

//Request Body

{

"merchant_id": "0000000000",

"transaction_id": "000000000000",

"amount": "000000000100"

}

Sample Response

{

"transaction_id":"000000000000",

"status": "approved",

"code": "000",

"reason": "Transaction successful!"

}

Handling VBV

VBV is an acronym form Verified for Visa, this is a security feature on cards which requires further authorization by card holder when such cards are used for online transaction.

If your payment request get a response as shown below, it means the request

requires further authorization by card holder. Simply redirect your user to the

url specied in the reason field in the response. The URL takes the

user to his card issuing bank secure ACS page to complete transaction

{

"status": "vbv required",

"code": 200,

"reason": "https://test.theteller.net/v1.1/3ds/resource/authentication/000000000000"

}

After your user completes payment authorization, user is redirected to your provided 3d_redirect_url. The result of the transaction is appended to the url.

https://redirect_url?code=000&status=successful&reason=transaction20%successful&transaction_id=000000000000

Mobile Money Payments

Theteller API processes multiple mobile money platform MTN, Vodafone, Airtel, Tigo. Every request requires the following request headers.

Request Parameters

| Parameter | Required | Type | Description |

|---|---|---|---|

| merchant_id | true | string | Your merchant API key provided when you create an account. |

| transaction_id | true | string | Unique transaction reference provided by you. |

| amount | true | string | Amount to charge. |

| processing_code | true | string | This is a transaction type identifier. 404000 is default for

transfer

to mobile money "000200" for mobile money payment |

| r-switch | true | string | Account issuer or network on which the account to be debited

resides. "MTN" for MTN "VDF" for Vodafone "ATL" for Airtel "TGO" for Tigo "ZPY" for Zeepay "GMY" for G-money |

| desc | true | string | Text to be displayed as a short transaction narration. |

| subscriber_number | true | string | Mobile money wallet to charge (10 - 12). |

//Request Headers

Content-Type: application/json

Authorization: Basic base64_encode('your API username:your API Key')

Cache-Control: no-cache

To complete a successful payment request send the following request

Method: POST

Endpoint: /v1.1/transaction/process

//Request Headers

Content-Type: application/json

Authorization: Basic base64_encode('your API username:your API Key')

Cache-Control: no-cache

//Request Body

{

"amount" : "000000000200",

"processing_code" : "000200",

"transaction_id" : "000000000000",

"desc" : "Mobile Money Payment Test",

"merchant_id" : "Your Merchant ID",

"subscriber_number" : "233243124824",

"r-switch" : "MTN"

}

Sample Response

{

"transaction_id":"000000000000",

"status": "approved",

"code": "000",

"reason": "Transaction successful!"

}

API Keys

This section describes what API keys are and how to retrieve them.

Theteller authenticates your API requests using your account’s API keys. If you do not include your key when making an API request, or use one that is incorrect or outdated, Theteller returns an error.

All API requests exist in either test or live mode, and one mode cannot be manipulated by data in the other. To get your test api keys you need to sign up here

Obtaining your API Keys

Your API keys are available in the Dashboard by navigating to My

Account.

Only use your test API keys for testing and development.

If you cannot see your API keys in the Dashboard, this means you do not have access to them, kindly contact your Theteller support.

Test and live modes

The test and live modes function almost identically, with a few necessary differences:

- In test mode, payments are not processed by card networks or payment providers, and only our Test cards can be used

Plugins

This page list all plugins available on Theteller.

Plugins make integrations on Theteller a lot faster. Here are the plugins we

have

at the moment, please feel free to contact

ps_dev@payswitch.com.gh if

you need help developing a plugin or you've developed a plugin and want it

to

be listed here.

Wordpress

Woocommerce: WooCommerce

is an eCommerce store plugin for selling both digital and physical products

-

Download Theteller

WooCommerce

Plugin

Magento

Magento is a modern cloud commerce platform with an open-source ecosystem.

Download Theteller Magento PluginMobile SDK

Theteller android sdk allows you to integrate payment faster into you android mobile app.

Download Theteller Android SDKTheteller Swift sdk allows you to integrate payment faster into you IOS mobile app.

Download Theteller Swift SDKOpenCart

OpenCart is an online store management system. It is PHP-based.

Download Theteller OpenCart PluginTest Bank Account

Test Bank Accounts for transfers to bank account.

Kweku Adjei

1082000131684304

Bank: ADB

Theteller Response Codes

| Code | Reason |

|---|---|

| 000 | Transaction successful |

| 101 | Insufficient funds in wallet |

| 101, 105 | Insufficient funds in wallet |

| 100 | Transaction not permitted to cardholder |

| 102 | Number not registered for mobile money |

| 103 | Wrong PIN or transaction timed out |

| 104 | Transaction declined or terminated |

| 105 | Invalid amount or general failure. Try changing transaction id |

| 111 | Payment request sent successfully |

| 107 | USSD is busy, please try again later |

| 114 | Invalid Voucher code |

| 200 | VBV Required |

| 100 | Transaction Failed or Declined |

| 600 | Access Denied |

| 979 | Access Denied. Invalid Credential |

| 909 | Duplicate Transaction ID. Transaction ID must be unique |

| 999 | Access Denied. Merchant ID is not set |

List of Banks

| Bank Code | Bank Name |

|---|---|

| SCH | STANDARD CHARTERED BANK |

| ABG | ABSA BANK GHANA LIMITED |

| GCB | GCB BANK LIMITED |

| NIB | NATIONAL INVESTMENT BANK |

| ADB | AGRICULTURAL DEVELOPMENT BANK |

| UMB | UNIVERSAL MERCHANT BANK |

| RBL | REPUBLIC BANK LIMITED |

| ZEN | ZENITH BANK GHANA LTD |

| ECO | ECOBANK GHANA LTD |

| CAL | CAL BANK LIMITED |

| PRD | PRUDENTIAL BANK LTD |

| STB | STANBIC BANK |

| GTB | GUARANTY TRUST BANK |

| UBA | UNITED BANK OF AFRICA |

| ACB | ACCESS BANK LTD |

| CBG | CONSOLIDATED BANK GHANA |

| SGG | SOCIETE GENERALE GHANA |

| FNB | FIRST NATIONAL BANK |

| UNL | UNITY LINK |

| FDL | FIDELITY BANK LIMITED |

| SIS | SERVICES INTEGRITY SAVINGS & LOANS |

| BOA | BANK OF AFRICA |

| DFL | DALEX FINANCE AND LEASING COMPANY |

| FBO | FIRST BANK OF NIGERIA |

| GHL | GHL Bank |

| BOG | BANK OF GHANA |

| FAB | FIRST ATLANTIC BANK |

| SSB | OmniBSIC Bank |

| GMY | G-MONEY |

| APX | ARB APEX BANK LIMITED |